Market Economics

The hotel market gets back into gear | by Giorgio Costa

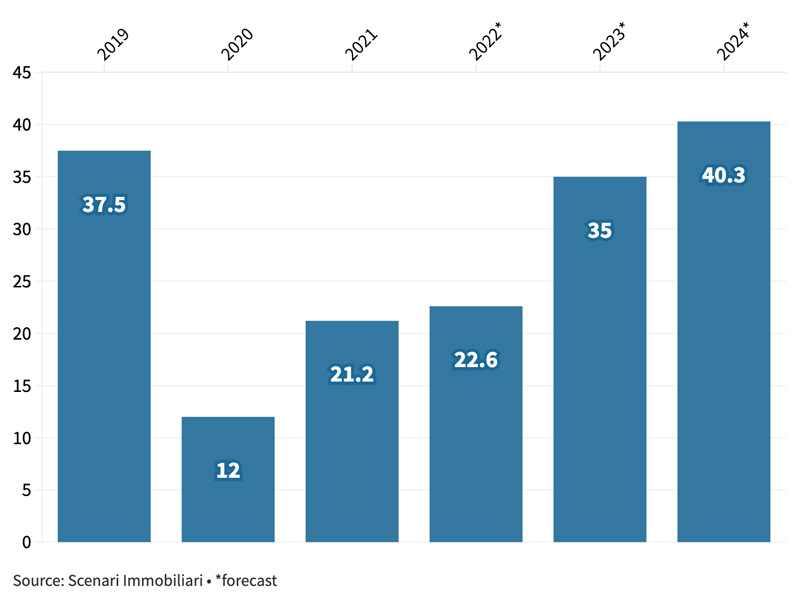

The tourism industry is putting the disastrous Covid-19 period behind it and is once again seeing growth in revenues and investments with no sign of the widely expected fall in hotel real estate prices. In this sector, global real estate investments more than doubled in 2021 year-on-year to reach almost €70 billion. In Europe, the hotel real estate market generated revenue of €21.2 billion in 2021 and is expected to reach €26.6 billion in 2022. This trend is also confirmed in Italy with a 2021 turnover of €2.5 billion, a figure that is expected to increase to €3.1 billion in 2022.

These are a few of the figures contained in the 2022 Report on the hotel real estate market presented on July 7 in Milan during Hospitality Forum 2022, organised by Castello SGR (one of the most important investors in this segment) and Scenari Immobiliari. Following the first quarter of 2022, the estimates for international tourist arrivals were revised up to around 70% of the 2019 figure, i.e. around €1.05 billion. 2022 is therefore expected to be a year of recovery for international tourism, with the uptick likely to be driven mostly by domestic tourism. According to estimates, the pre-pandemic levels of 1.4 billion arrivals will be reached in the second half of 2023 or early 2024. In Europe, investments in tourism accommodation facilities totalled €16.8 billion in 2021. The transactions concerned properties of different levels, from two to five-star luxury, with four-star hotels making up the majority.

In Italy, the transactions concluded in 2021 and early 2022 confirm the interest shown by investors, including international buyers, in prime and often iconic locations. An estimated 76 three-, four- and five-star hotels with a combined total of more than 11,400 rooms were purchased. Forecasts for the current year are positive with European real estate turnover expected to increase by just under 30%, with the Italian market likely to see comparable growth. However, the complex macroeconomic situation means that greater caution is called for in forecasting future trends. We will have to wait until early 2024 for volumes to stabilise at the highest levels reached in the past.

European Hotel Real Estate Turnover (billion euros)

“Flexibility and versatility will be the main drivers in 2022 and the subsequent two years because they cater to the needs of “new travellers” such as unorganised workers, frequent visitors and off-season tourists. This will lead to a widespread increase in overnight stays, record-breaking occupancy rates for certain periods of the year, and combined business and leisure trips,” says Francesca Zirnstein, managing director of Scenari Immobiliari. “However, there remain several elements that may have a negative impact on the industry, such as potential new waves of Covid-19 infection, rising inflation, higher energy costs and prices of accommodation, labour shortages, and a slow restart of trade fair and meeting tourism.”

In Europe, the revenue generated by the tourism industry, and the hotel industry in particular, has been sustained by domestic demand not only in premium holiday locations but also in secondary locations (taking both hotel and non-hotel offerings into account). The general expectation of a fall in property prices, even for high-quality real estate, has so far not materialised and there continues to be a wide gap between the pressure exerted by opportunistic investors and the value of assets, with some central European markets displaying a lack of dynamism due to resistance to the new demands. In 2021, the Italian hotel real estate segment shared the top tiers of the investment growth podium with the logistics sector, thanks to an increase in revenue of more than 65% compared to 2020. This growth appears even more significant as it comes on the back of a very difficult twelve month period and brings the segment’s performance closer to that of 2019 when the highest levels of investment were reached. Significant revenue growth of 25% is expected for 2022, bringing the indicator in line with the 2018 figure, although we will have to wait until 2024 to exceed the 2019 results.

“The trend in the tourism and hotel market both in Europe and in Italy is showing a high degree of dynamism and this is undoubtedly very good news,” says Giampiero Schiavo, managing director of Castello SGR. “Alongside the national and local institutions, it is our duty as operators to support the recovery by meeting the changing needs of travellers and offering them a higher-value experience. This is essential if our country is to remain one of the world’s top travel destinations. All market players must step up their efforts to further develop off-season tourism and to improve the services and infrastructures needed to attract visitors not only to large cities and iconic locations but to all Italian regions, thereby creating a virtuous circle.”

Source: Hospitality Forum 2022, Scenari Immobiliari e Castello SGR

October 2022