Market Economics

The impact of Covid-19 on construction and global tile consumption | by Andrea Cusi

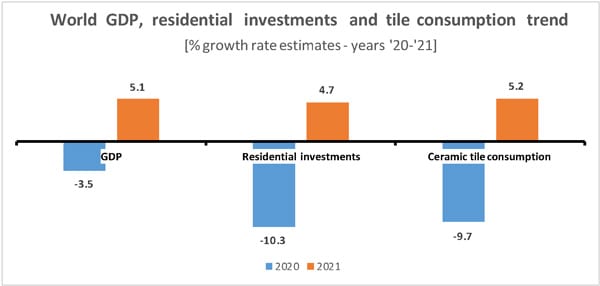

The global economy is in the throes of the worst recession since the Second World War with world GDP expected to see an even bigger fall than in 2009. Although a recovery is expected in 2021, the outlook remains highly uncertain due to the potential for a second wave of the Covid-19 pandemic, protectionist tensions and the impact of the economic policies adopted in response to the crisis. These are a few of the findings of the Confindustria Ceramica – Prometeia Forecasting Monitor for the two-year period 2020-2021. Albeit with wide margins of uncertainty, and assuming a gradual return to normality between the summer and the end of the year, world GDP is expected to contract by 3.5% in 2020 and recover by 5.1% next year. In this scenario, the Eurozone economy has been the worst hit, with GDP expected to fall by 7.3% in 2020, followed by a 4.9% rebound in 2021. The anticipated contraction in the United States in 2020 is in line with the global decline (-3.5%), while the recovery forecast for 2021 is less dynamic (+3.4%). China is expected to see a sharp slowdown in 2020 (+1.4%), followed by a strong rebound in 2021 with GDP growth of more than 9%. Finally, India is expected to experience a decline of 1.0% in 2020 and a recovery of around 6.7% next year.

The global economy is in the throes of the worst recession since the Second World War with world GDP expected to see an even bigger fall than in 2009. Although a recovery is expected in 2021, the outlook remains highly uncertain due to the potential for a second wave of the Covid-19 pandemic, protectionist tensions and the impact of the economic policies adopted in response to the crisis. These are a few of the findings of the Confindustria Ceramica – Prometeia Forecasting Monitor for the two-year period 2020-2021. Albeit with wide margins of uncertainty, and assuming a gradual return to normality between the summer and the end of the year, world GDP is expected to contract by 3.5% in 2020 and recover by 5.1% next year. In this scenario, the Eurozone economy has been the worst hit, with GDP expected to fall by 7.3% in 2020, followed by a 4.9% rebound in 2021. The anticipated contraction in the United States in 2020 is in line with the global decline (-3.5%), while the recovery forecast for 2021 is less dynamic (+3.4%). China is expected to see a sharp slowdown in 2020 (+1.4%), followed by a strong rebound in 2021 with GDP growth of more than 9%. Finally, India is expected to experience a decline of 1.0% in 2020 and a recovery of around 6.7% next year.

The Covid-19 emergency is also having a major impact on residential construction investments, which are expected to fall by an estimated 10.3% this year. Following the widespread global downturn in 2020, investments are projected to pick up by 4.7% in 2021, but not sufficiently to make up lost ground.

The Covid-19 emergency is also having a major impact on residential construction investments, which are expected to fall by an estimated 10.3% this year. Following the widespread global downturn in 2020, investments are projected to pick up by 4.7% in 2021, but not sufficiently to make up lost ground.

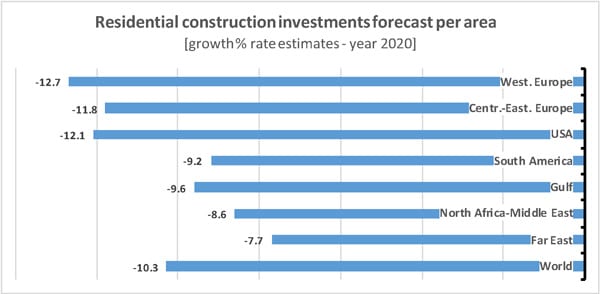

In particular, the Covid-19 emergency in the United States has interrupted the recovery in construction, which will be further hampered by the slump in employment in the second quarter, leading to a 12% overall decline in investments in 2020. A similar trend can be seen in Western Europe, although a more significant recovery is expected in 2021 (+7.2%). In Germany, the construction sector was exempted from the lockdown rules, and a limited fall in investment is expected in the second quarter followed by a gradual recovery in the second half of 2020.

In France and Spain, the projected recovery in the second half of the year will not be sufficient to prevent a sharp drop in residential construction investments, while in the UK the impact of Covid-19 has further contributed to a slowdown that was already underway prior to the emergency. In Central and Eastern Europe, the decline in investment is expected to intensify in 2020 as a result of the lockdowns, resulting in an expected contraction of 11.8%. Forecasts for the Far East also indicate a drop in construction investment of 7.7% in the current year.

In India, the pandemic has worsened the existing crisis and is expected to lead to a substantial drop in investment, while the decline in investment is expected to be more limited in China, where the recessionary phase is expected to bottom out as early as the second half of the year.

The outlook for construction in the Gulf region in 2020 is likewise negative with an expected decrease of 9.6% compared to 2019. North Africa and the Middle East are expected to see a contraction in the residential sector in 2020 (forecast -8.6%), while in Latin America the pandemic has abruptly halted a phase of recovery in construction investments that began in 2019, with investments in the region forecast to contract sharply (-9.2%).

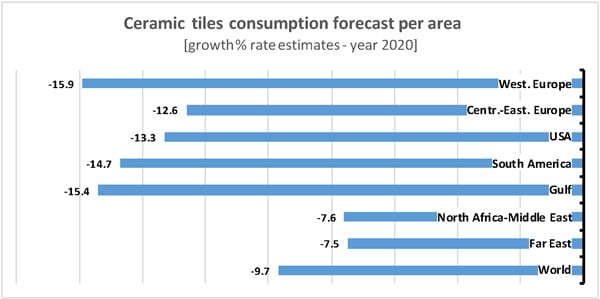

In this scenario we can expect to see a fall in global demand for ceramic tiles during the current year. In Western Europe in particular, the lockdowns imposed in many countries combined with the effects of the economic recession will lead to a double-digit decline in tile consumption (-15.9%) in 2020. The anticipated rebound in consumption will only partially offset the expected losses for the current year. In Central and Eastern Europe the downturn is expected to be around 13% in 2020, while the recovery (+6%) forecast for 2021 will not be sufficient to return to 2019 levels. A sharp decline in tile consumption is also forecast in the United States, bringing the expected contraction in the NAFTA region to -11.9% this year. This will be followed by an expected upswing of +4.3% in 2021, again not sufficient to recover the losses of 2020. In the Far East, the effects of Covid-19 added to an existing scenario that was already showing signs of weakness, and the current year is expected to close with a further fall (-7.5%). The contraction in the Gulf region is more significant with an expected drop in consumption of -15.4%, while a 7.6% contraction is estimated in the Middle East and North Africa. Finally, the Latin American ceramic tile market is expected to decline sharply this year, down 14.7% compared to 2019.

In this scenario we can expect to see a fall in global demand for ceramic tiles during the current year. In Western Europe in particular, the lockdowns imposed in many countries combined with the effects of the economic recession will lead to a double-digit decline in tile consumption (-15.9%) in 2020. The anticipated rebound in consumption will only partially offset the expected losses for the current year. In Central and Eastern Europe the downturn is expected to be around 13% in 2020, while the recovery (+6%) forecast for 2021 will not be sufficient to return to 2019 levels. A sharp decline in tile consumption is also forecast in the United States, bringing the expected contraction in the NAFTA region to -11.9% this year. This will be followed by an expected upswing of +4.3% in 2021, again not sufficient to recover the losses of 2020. In the Far East, the effects of Covid-19 added to an existing scenario that was already showing signs of weakness, and the current year is expected to close with a further fall (-7.5%). The contraction in the Gulf region is more significant with an expected drop in consumption of -15.4%, while a 7.6% contraction is estimated in the Middle East and North Africa. Finally, the Latin American ceramic tile market is expected to decline sharply this year, down 14.7% compared to 2019.

To conclude, world ceramic tile consumption is expected to fall sharply in 2020, down 9.7% from the previous year, followed by a partial recovery (+5.2%) in 2021.

June 2020