Market Economics

How real estate markets are changing during the Covid-19 pandemic | by Alessandra Ferretti

According to the report Global Real Estate Perspective – Highlights by Jones Lang Lasalle published on 7 August 2020, all real estate markets are facing a deep but short recession amid the pandemic. The company’s analysts investigated market trends during the second quarter of 2020, noting widespread uncertainty which in turn is leading to longer decision-making processes.

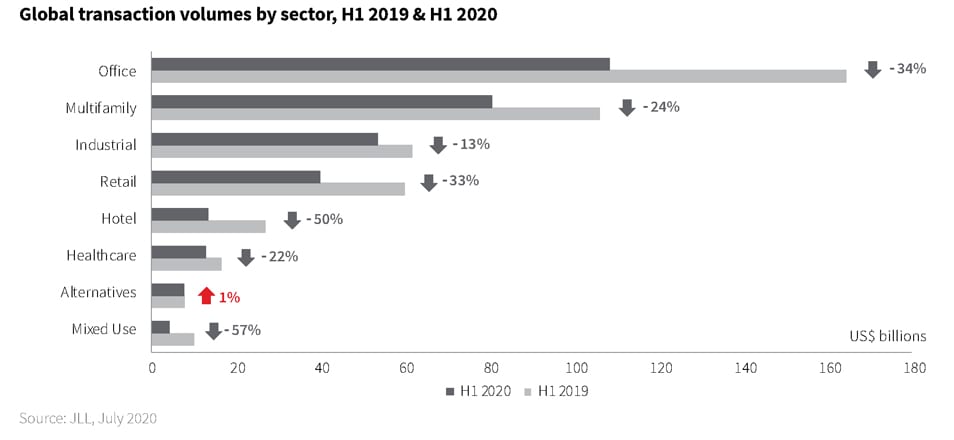

The global economy contracted during Q1 2020 for the first time in 11 years, with global GDP expected to decline by roughly 5% in 2020. Global commercial real estate investment in Q2 2020 dropped 55% year-on-year to US $107 billion, equating to a 29% decline in H1 2020, as the impact of the pandemic became evident.

The Americas and Asia Pacific saw activity decrease by 37% and 32% respectively during H1, while Europe, the Middle East and Africa (EMEA) contributed to a more muted fall of 13%.

Investor strategies are currently focused on defensive strategies and portfolio expansion.

But let’s take a look at how the private, professional and logistics real estate markets have developed across the various continents.

Residential market

The living sector continues to be the most liquid commercial real estate sector in the United States. Investor demand in Europe also remains high. There are some concerns regarding modest downward pressure on rents, reflecting the potential impact of the ending of various government support schemes and increased unemployment.

Stronger sales performance was evident in the Asia Pacific residential market in the second quarter. In Mainland China, home sales rebounded in Beijing and Shanghai as temporarily discounted prices encouraged cautious buyers.

The hotel and hospitality sector

The hospitality sector has been hit hard by the pandemic with the ongoing pullback in both leisure and business travel continuing to flow through to the sector. Hotel markets across the globe have started to reopen, but revenue per available room is significantly down on last year.

Heightened uncertainty has impacted investor appetite for hotels, with asset valuations becoming more challenging. Acquisitions are largely on hold, with the exception of several transactions well underway at the onset of the pandemic or which involved the conversion of hotels to an alternative use.

The professional sector

The resumption of industrial production following the gradual lifting of lockdown restrictions helped to ease supply chain disruption. Sectors such as medical supplies, grocery and online sales proved resilient and have boosted demand.

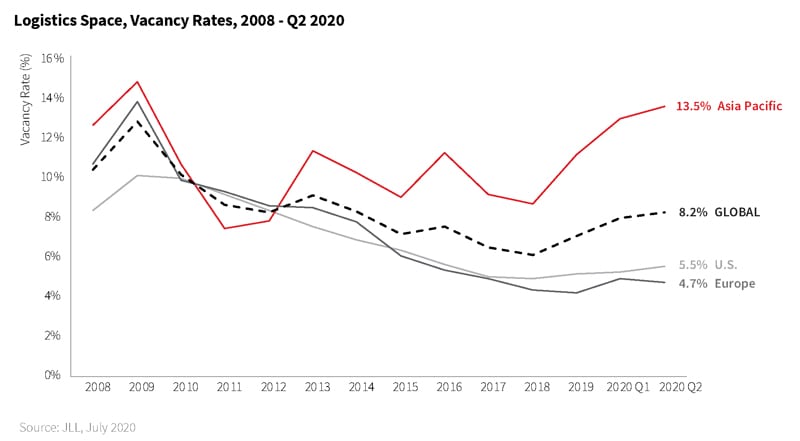

Developers have quickly re-started construction projects amid future demand projections. Momentum in the rental market has eased due to stalling rents in all three regions (Asia Pacific, Europe and the Americas).

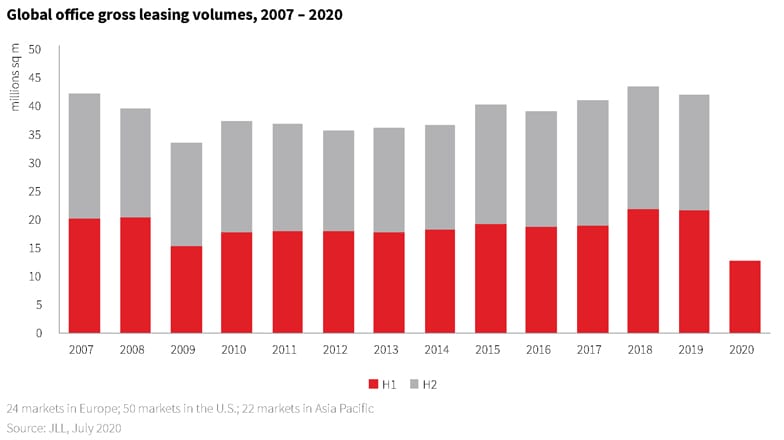

Office markets witnessed a sharp fall in activity across all regions: -65% in the Americas, -61% in Asia Pacific and -49% in Europe. Numerous measures have been adopted in offices including some level of de-densification that meets social distancing requirements. Analysts confirm that offices will remain a fundamental part of corporate culture.

Click here to download the Report.

August 2020